Tips for Avoiding Tax Season Scams

Scams Are Getting Smarter

For many years tax scams existed solely as annoying phone calls from individuals pretending to work for the IRS. Most scams involved asking for social security numbers or credit/debit card numbers, which is something the IRS would never do.

Now that awareness of this scam tactic has spread, the scammers are wising up and sending physical mail in an attempt to gain access to that same sensitive information. The IRS does send mail, so these scams are harder to identify.

As anyone with a crowded spam folder will also know, tax scams frequently show up as emails. These email scams are often more subtle and won’t ask for your personal information directly. Instead, they may ask you to click a link or download a file which embeds malware onto your computer. This malware will scrub through your computer looking for personal data.

If you have the slightest inkling that you may be the target of a tax scam– contact your tax professional at BBB for peace of mind and assistance with combating scammers.

How to Identify a Phone Tax Scam

The classic method of IRS scams is via telephone. Below are a few things that the IRS will never do over the phone, according to their website.

- Demand immediate payment

- Call about taxes owed without first mailing a bill

- Ask for credit or debit card numbers over the phone

- Require you to use a specific payment method for your taxes, such as a prepaid debit card

- Threaten to involve local police or other law-enforcement groups

Because of all these easy giveaways, identifying a phone scam is fairly straightforward.

How to Identify a Mail Tax Scam

Catching a mail scam is a little trickier, but still possible, even if you don’t know much about the IRS or taxes. The tips above are all important to remember when identifying a mail scam, but with mail it gets more complicated. Check out this page on how the IRS contacts taxpayers and then read the tips below that are specifically tailored toward scam mail.

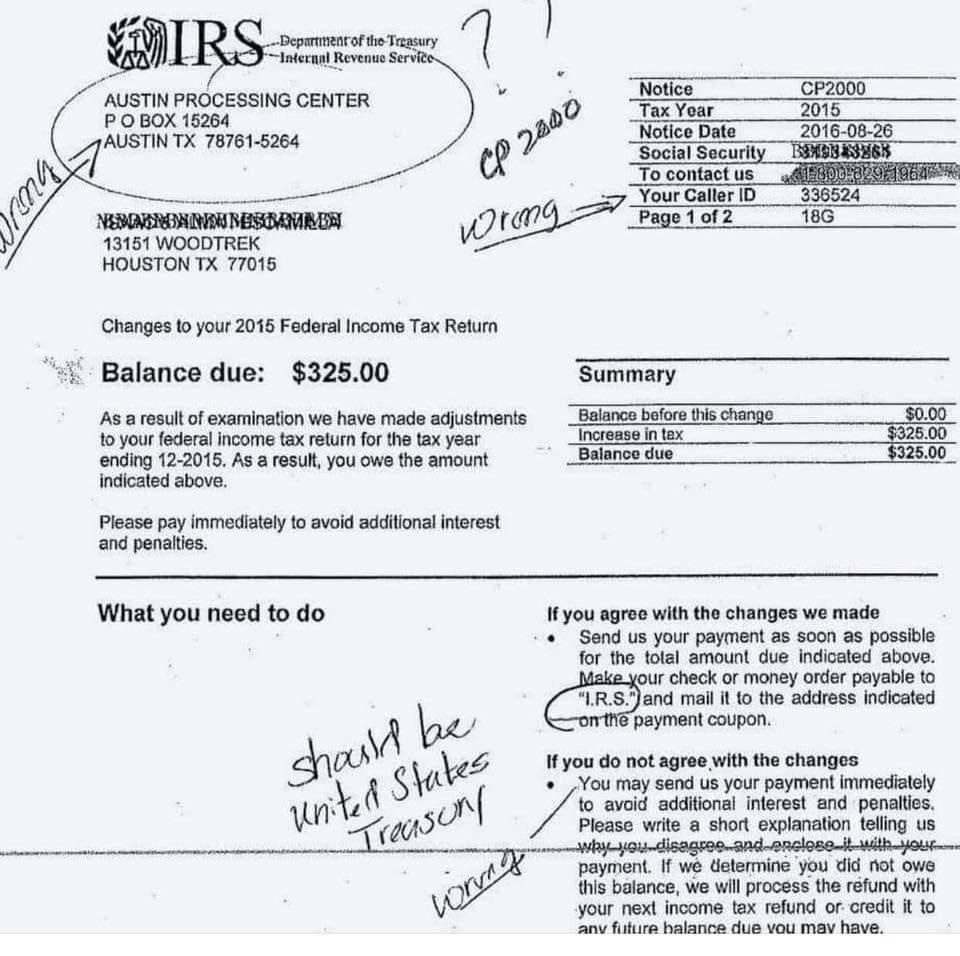

- Check the return address. Official IRS notices and correspondence will come from an Internal Revenue Service address. Look up the address on the piece of mail and see if it’s an actual IRS or Treasury office.

- Check the payment info. If the letter is asking for a payment, find where they say who to make the check or money order out to. Any checks to the IRS should be made out to the United States Treasury. Some scam letters ask for payments to the “I.R.S.” which is incorrect.

- Check the explanation. The IRS will always have a specific, detailed explanation of what the notice is about. If a balance is due, they will explain why. Some scammers (like below) say vague things such as, “As a result of examination we have made adjustments,” which fails to convey any real information.

- Check the notice/letter number. Every IRS notice or letter has a notice (CP) or letter (LTR) number on either the top or the bottom right-hand corner. Use this page to search for your notice in the IRS database.

How to Identify an Email Tax Scam

Email scams are probably the easiest to identify because the IRS does not initiate contact with you without your consent. They will also not ask you to send any personal information via email and will instead redirect you to a secure IRS online if they do contact you by email. The safest thing to do if you spot an email claiming to be from the IRS is delete it. You will get a notice in the mail if it is legitimate. Read this page about IRS email contact and be sure to follow these tips on scam emails.

- Do not click any links

- Do not open any attachments

- Do not reply

- Do not send personal information (SSN, credit card number, driver’s license number, etc.) via email

If You Are Targeted in a Tax Scam

If you suspect you may be targeted by scammers trying to impersonate the IRS or another government body, contact our tax experts immediately, no matter how insignificant the amount may seem.

Tags

Categories

Services

- Business Advisory Services (153)

- Audit & Assurance (9)

- Business Valuation (17)

- Estate & Trust (26)

- Fraud Examination (15)

- Litigation Support (11)

- Tax Planning & Compliance (343)