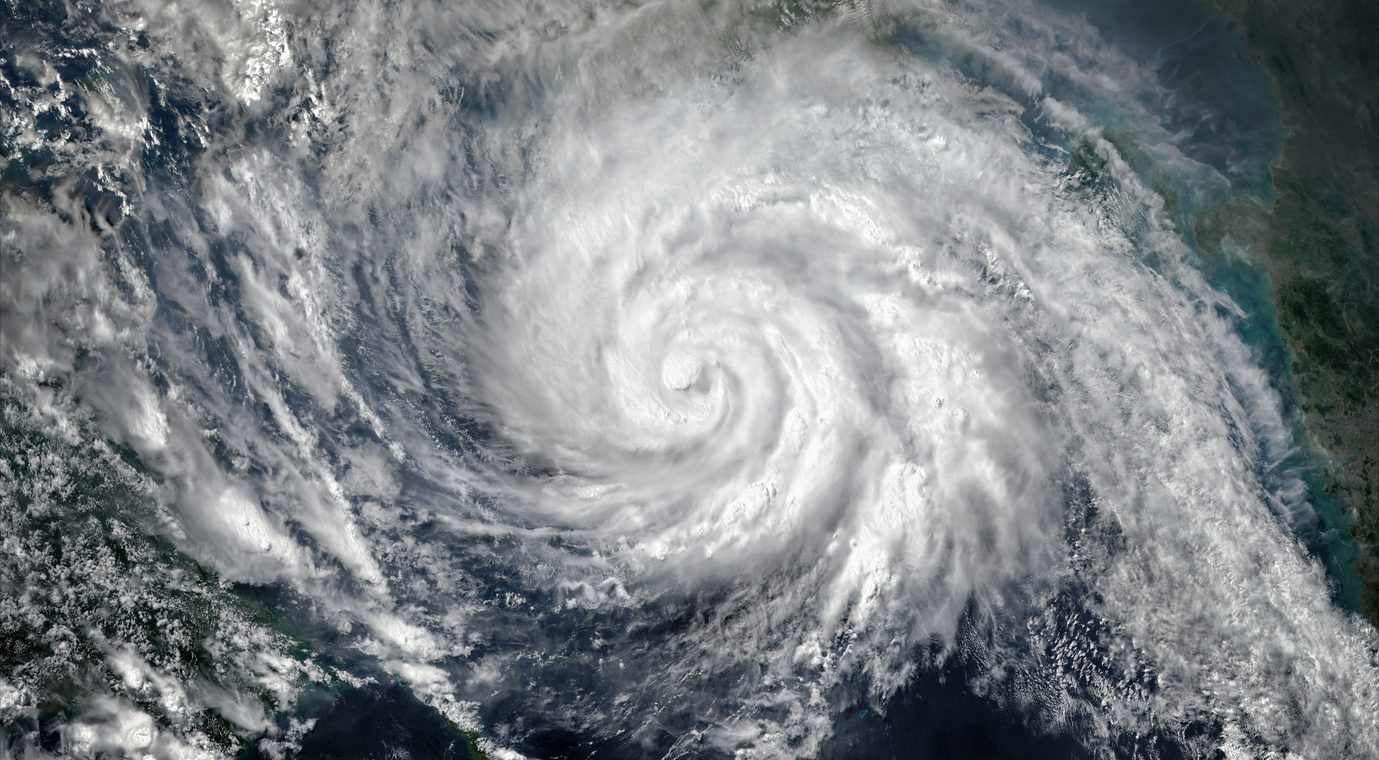

IRS Announces Hurricane Tax Relief for SC, NC, GA, and More

In the wake of Hurricane Helene, the IRS announced another piece of tax relief on October 1st, 2024. This applies to individuals and businesses in the entire states of South Carolina, North Carolina, and Georgia, as well as parts of Virginia, Tennessee, and Florida.

Taxpayers in these areas now have until May 1, 2025, to file various federal individual and business tax returns and make tax payments. Among other things, this includes 2024 individual and business returns normally due during March and April 2025 as well as 2023 individual and corporate returns with valid extensions and quarterly estimated tax payments.

For more information on this recent round of tax relief, read this IRS news release.

For more information on tax relief in disaster situations, visit this page.

Please contact us if you have any questions.

Tags

Categories

Services

- Business Advisory Services (153)

- Audit & Assurance (9)

- Business Valuation (17)

- Estate & Trust (26)

- Fraud Examination (15)

- Litigation Support (11)

- Tax Planning & Compliance (343)